After nearly a century of policy irrelevance, Georgism is poised to make a comeback. The basic ideas ring true to my YIMBY ears, yes and’ing a lot of what pro-housing reformers have been saying for the last decade.

In this conversation, we not only clarify the ins/outs of Georgist policy, we also get into what implementation — technically, legally, and politically — actually requires. And, most exciting from my perspective, we end with a recap of the wins that Lars Doucet and Greg Miller have already achieved in barely a year of policy advocacy at the Center for Land Economics.

(Also, scroll to the end for a full list of articles mentioned in this conversation)

Introducing Greg & Lars

[00:01 – 00:07]

Urban reformers are made, not born.

Lars Doucet started out thinking about urbanism as an architectural student. A couple twists and turns later, he began reading Georgist thought and wound up as a developer in the gaming industry. As a gaming dev, he witnessed several MMORPGs unintentionally recreate land bubbles that disrupted the worlds built for players and, in at least on case, saw a land value taxation recreated from first principles as a fix.

On the flip side, Greg Miller’s got his start in urbanism as a tenant organizer during college in South Bend, Indiana. He had heard the stories of the YIMBY movement in places like San Francisco, but came to the conclusion that land use liberalization might not be the binding constraint development in South Bend. After college, Greg took a job at HUD, but, for all the agency’s focus on housing, he found a total lack of discussion on tax policy as a determinant of affordability.

How Georgists See the World

[00:07 – 00:16]

Greg goes on to explain What Georgist’s think is wrong with the world.

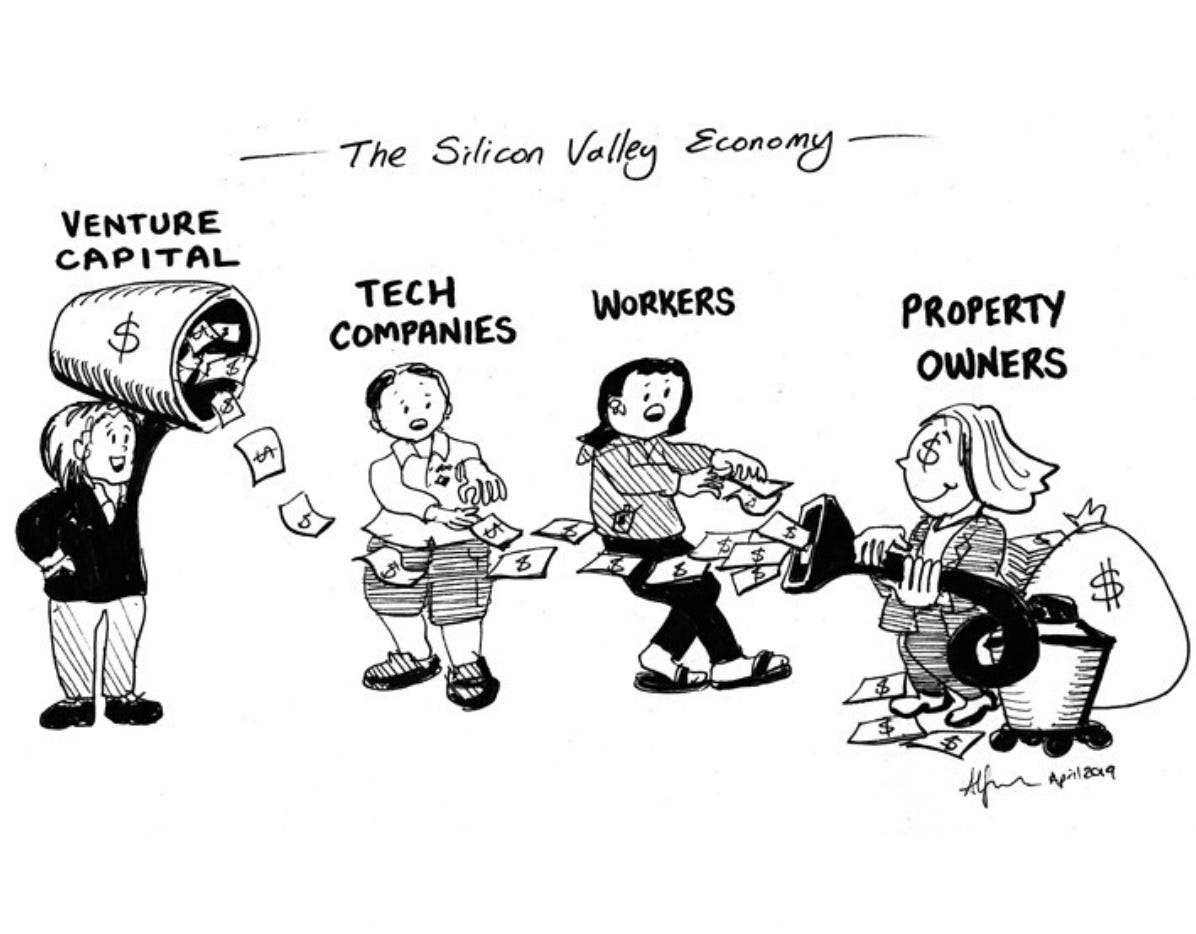

Georgism begins from a simple institutional premise: land is a fixed, non-produced input required for all economic activity. In a growing economy, landowners can extract more and more from productive workers, businesses, and investors — all by dint of having gotten to the party first.

Lars go on to add that, conceptually, Georgism sits in a place between capitalism and socialism. Georgism introduces a third factor — land. When land is privately monopolized, its owners can charge for access and capture value generated by population growth, public investment, and economic clustering—without contributing productive activity.

Greg and Lars then go on to explain that Georgism comes out of a period of rapid urbanization in American history. The problems that this created were eventually addressed via car-based suburban sprawl, but this approach has reached the limits of its ability to scale. With our ability to (functionally) sprawl exhausted, we see rising inequality and a “second Gilded Age.”

The Georgist Solution: Socialize Land Value

[00:16 – 00:25]

Greg explains the two main approaches to capturing land value for the public good: land leasing and land value taxation.

In land easing, the government rents out publicly held land for development and acts explicitly as a landlord. This is a pre-appropriation strategy that prevents publicly created land values from ending up in private hands.

The other approach, land value taxation, reappropriates land values via direct taxation. The core mechanisms are:

Taxing land, not buildings:

Taxing buildings discourages construction

Taxing land discourages speculation without reducing supply (i.e. taxing land won’t decrease supply like taxing the production of widgets would)

Capitalization effects:

Land taxes are capitalized into lower purchase prices, not higher rents

Holding costs rise while acquisition costs fall

No pass-through to renters:

Rents are determined by supply and demand, not landlord costs

Because land supply is perfectly inelastic, taxes cannot reduce it

As a policy proposal, land value taxation is best understood as a tax shift, not a tax increase; the larger idea is to not only increase taxes on land, but lower taxes on everything else. The goal is to capture socially created value while removing penalties on production.

Technical Questions on the Arcana of Land Value Taxation

[00:25 – 00:37]

Lars and Greg answer technical questions on land value taxation, including:

What’s the best way to value multi-family residential development for purposes of assessment?

What are the pros and cons of annual reappraisals?

What is the Least You Can Do method for land valuation?

Why Land Value Taxation Is Difficult to Implement

[00:37 – 00:46]

Greg explains that the primary barriers to land value taxation are institutional and legal, not technical. Different state constitutions often impose uniformity clauses requiring identical tax treatment of land and improvements. The severity of this constraint varies by state.

Key barriers include:

Constitutional definitions bundling land and buildings

Uniformity clauses restricting split-rate taxation

Assessment caps (e.g., California’s Prop 13) freezing land values

Workarounds exist, such as universal building exemptions that effectively shift taxes toward land without violating constitutional language. Feasibility is state-specific and the result is a patchwork of legal environments where reform ranges from straightforward to extremely difficult.

From a political strategy perspective, Greg and Lars see a path forward by passing land value taxation, even as a split-rate, such that tax bills for homeowners don’t go up. What they envision is dramatically raising the effective tax bill on land uses like downtown parking lots (i.e. extremely high-value land used at extremely low intensity).

The Center for Land Economics: First-Year Wins and Plans for 2026

[00:46 – 00:57]

Greg explains the Center for Land Economics’ main work streams are organized as:

Education and mass organization

Supporting and publishing open source research and software

Direct technical assistance, especially to local officials and organizing groups

Big wins from year 1 include:

Providing technical support with a Senator in the Ohio State Legislature, a City Council member in Syracuse, and other elected officials

Publishing a research paper that convinced a county assessor in Maryland to update their assessment practices such that the county stopped undervaluing vacant land by a factor of 10

Looking ahead to 2026, the goals include:

Expanding state-level enabling legislation

Supporting jurisdictions with high administrative readiness

Normalizing land-centric frameworks in housing and fiscal policy debates

Postscript

This was a fun conversation to record. Lars and Greg are working on an important issue and it was fun to talk though their ideas with such and actively engaged audience (thanks to Stephanie Nakhleh, Max Clark, Janning⭐, Elle Griffin, Peter Kaplan, and about 52 other folks who tuned live).

Next week we’ll be continuing on with a conversation on YIMBYism with YIMBY Action Executive Director, Laura Foote. This will be a 201 level conversation, so if you’ve ever wanted to hear the inside baseball on YIMBY political strategy (there’s more than one), what YIMBY actually believe, and the handful of things YIMBYs disagree on…join us next week.