Building Solar Punk Utopia

Deploying the tech and building the markets we need to power the future

The following is the 3rd and final installment of my conversation with Sean Fleming on the future of municipal power systems.

For those just jumping in now, Sean is an advisor and investor working in the energy industry with deep expertise on the inner workings of investor-owned utilities, how modern power grids are built and maintained, and what’s next in the world of energy startups. He also writes about energy tech at Clean Energy Review.

Part 1: How to Power a City

Part 2: Why Nuclear is Not Enough

Part 3: Building Solar Punk Utopia

Continued from Part 2: Why Nuclear is Not EnoughManaging the Market

Jeff Fong: What I think I hear in all of this are attempts to redistribute demand across time. Now, I think I remember a conversation about smart home devices being used to incentivize people to do this en masse to smooth out demand — was that real?

Sean Fleming: There's a couple different layers to it, with varying degrees of effectiveness.

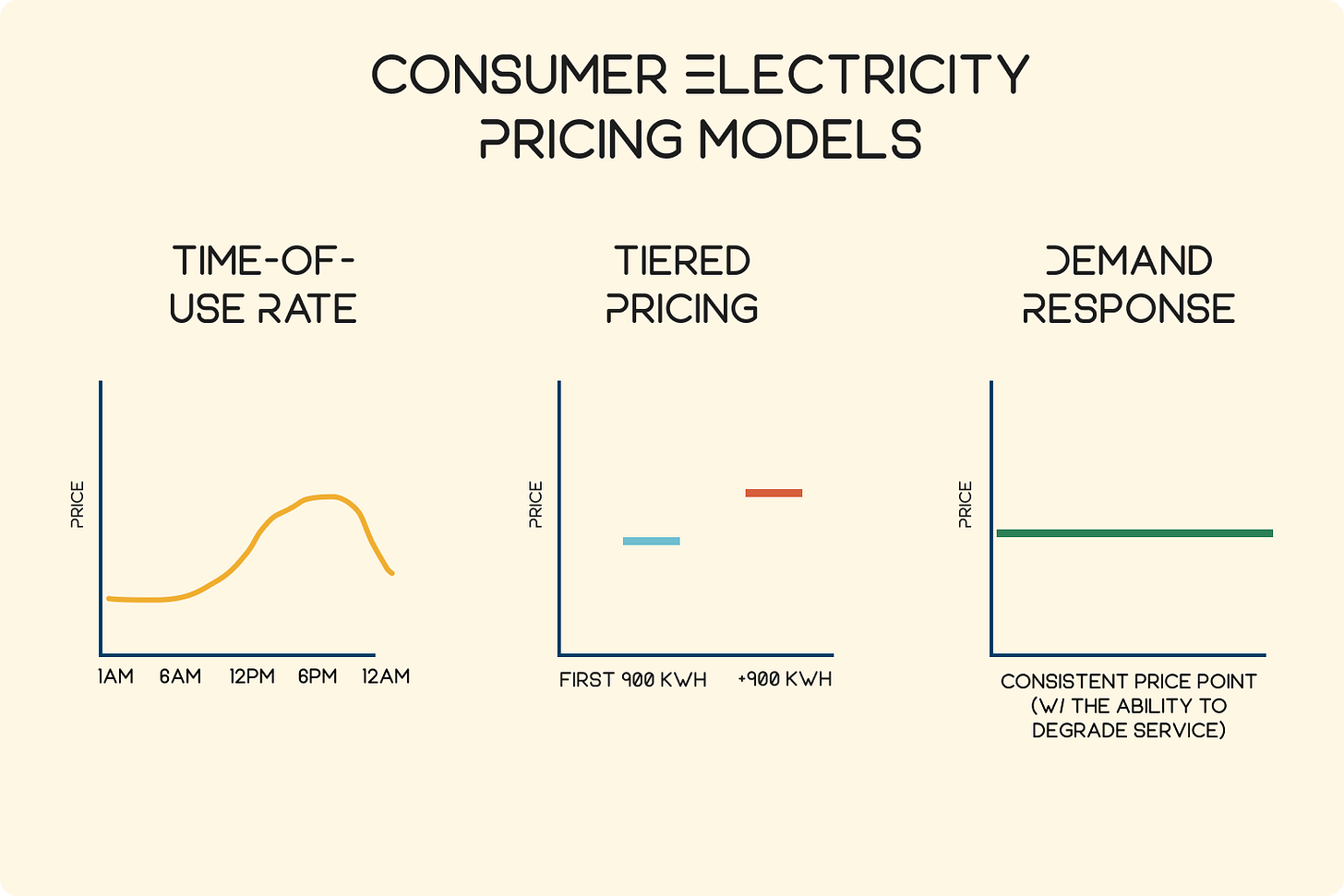

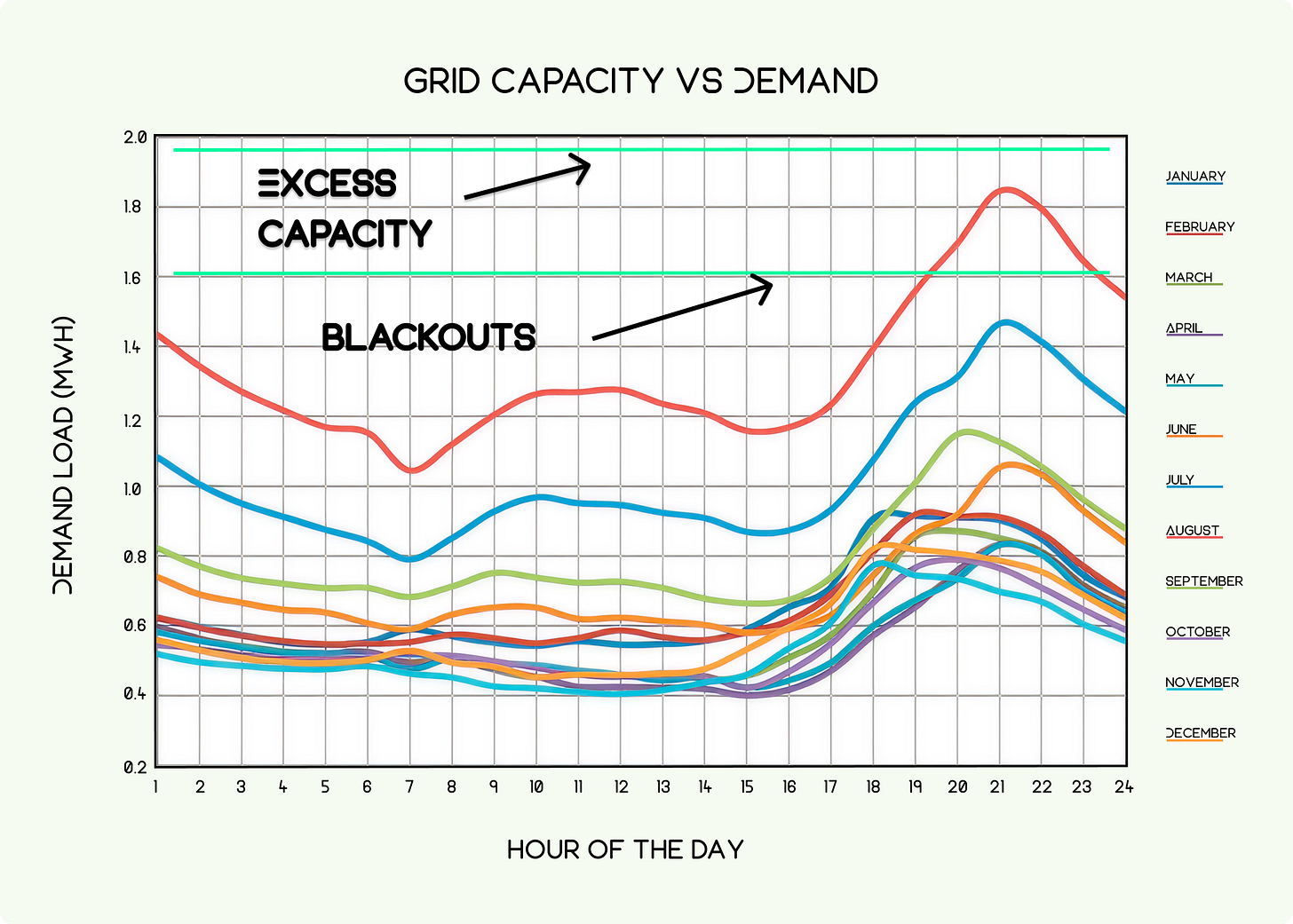

The one that's probably the widest spread is what's known as time of use rates. Basically a time of use rate is where, call it…between the hours of 4pm - 9pm or 5pm - 8pm, you have a higher price for power than during the rest of the day. And that's because those peak hours tend to occur during that period right where people are getting home from work, running the dishwasher, running the dryer, running the AC, watching their TV, cooking dinner with their electric stove, and so on.

Jeff Fong: So, surge pricing, but for power.

Sean Fleming: Exactly. And this was enabled primarily through smart meters. Even if they can't flag outages in real time, they do track when during the day power is being used, so you can do time of use rates. That’s in place in a lot of geographies that have summer peaks, but it's not everywhere.

I'm actually an LA Department of Water & Power (LA DWP) customer, and I get tiered pricing where I get, something like 900 kilowatt hours a month at tier one, and then above that I pay more. So it's not even in place everywhere in California.

The third lever is what's known as a demand response program.

The way to think about this is like you have some load in your home or business, whether it's from an air conditioner, or an EV charger, or a hot water heater. And if you receive a signal from the utility, that connected device will run at a reduced capacity (or just not run at all).

Generally, the utility will pay the homeowner some amount of money (say five to twenty bucks a month) for the right to trigger some set number of demand response events (maybe a dozen, maybe twenty) every year.

These aseful, but people don't like them much. It's a thing they notice right away.

Imagine it’s the hottest afternoon of the year, and snly your AC doesn't work properly. As a utility, you tend to need to trigger them at times that customers will be most impacted. So there’s a limit to how much these can be used and they tend to be kind of expensive for what you get. It costs the utilities quite a lot to enroll people in these programs, and then, because it's like turning your AC off on the hottest day of the year, people require a large payment to participate.

In practice, they’ve not lived up to the promise that people originally hoped for.

The third lever comes from residential batteries, either stationary or in EVs. If demand response is about taking a given load down to zero, then batteries have the ability to offset a whole home’s load or even feed power back into the grid during times of need. This almost comes full circle to time-of-use rates in the sense that pricing is the key lever, but it’s all happening programmatically without the homeowner having to do anything.

This is the future, and will provide a bigger impact than e.g. smart thermostats, but the specific programs / business models / deployments are still getting ironed out.

Searching for Solar Punk

Jeff Fong: Let’s talk about electric vehicles

Sean Fleming: EVs are a bit of a double edged sword. People talk about data centers, but the hidden issue for a lot of utilities across the country is actually EVs because they’re like infill power demand that can basically double the amount of energy that an individual neighborhood might need at any given time.

Jeff Fong: This raises a question in my mind…like EVs are only possible because we've gotten so much better at battery technology, right? Why can't we just use solar panels all day, charge some batteries, and then have that saved up power during peak hours? Why don’t we already live in solar punk utopia?

Sean Fleming: We're getting there in places like the US southwest. There are a couple issues that make it harder than it might seem.

The first is that even though batteries are getting a lot cheaper, they're still expensive. Particularly, the types of batteries put into residential homes, like a Tesla Powerwall in somebody's garage, tend to be relatively expensive for what you get in terms of capacity. I looked at this last year and roughly you could buy a Powerwall or a Tesla Model 3 for the same battery capacity per dollar, but if you buy the Model 3 you’re getting a whole car!

But that's also the interesting part. Everyone's buying these EVs because they want a car to drive around. That now gives you this big battery that you can charge up with your home solar system and then discharge back into your home. The fire code and the electrical codes have not necessarily caught up with that yet, and we only see bi-directional charging in big trucks like the F150 Lightning and the Cybertruck, but I'm hoping that within the next couple of years that that becomes a very distinct possibility.

So the short answer is, yes, we are on the verge of a solar punk utopia. If you’re a remote worker, your car could be in your garage being charged by rooftop solar panels, you could charge this big EV battery during the day at a low cost, and then discharge it back into your home in the evenings. Because you’re getting dual use out of the EV battery, the costs can pencil out and you can dramatically reduce your grid power usage.

Jeff Fong: Can you give me a sense of scale for a Tesla battery? If you were to actually do that, would you drain the Tesla battery that evening? Could you run your house for like a day or two?

Sean Fleming: Most people could run their house off a Model 3 battery all evening and into the following day.

For context, most residential systems have like a 5-15 kilowatt hour battery. Your Tesla, depending on the model, might be anywhere from 55 to 100 kilowatt hours of capacity. The Hummer EV gets up to more than 200 kilowatt hours. So it's a lot more.

For example if you were in an emergency situation and you're trying to conserve power, you can likely run your home for a couple of days off of a Tesla Model 3 battery.

Why Infill Development is Hard

Jeff Fong: Let’s go back to the utilities for a second. I'm curious to get your opinion on something of an intra-urbanist housing debate.

So, within pro-housing circles, one or two people will make the case that we should just laterally sprawl forever because that’s the fastest way to bring new housing online. Granted, that’s like three people, but it’s a topic that occasionally comes up.

Do you have a sense of whether expanding power infrastructure laterally (i.e. servicing sprawl development) is harder than providing more power to concentrated areas (i.e. servicing infill densification)?

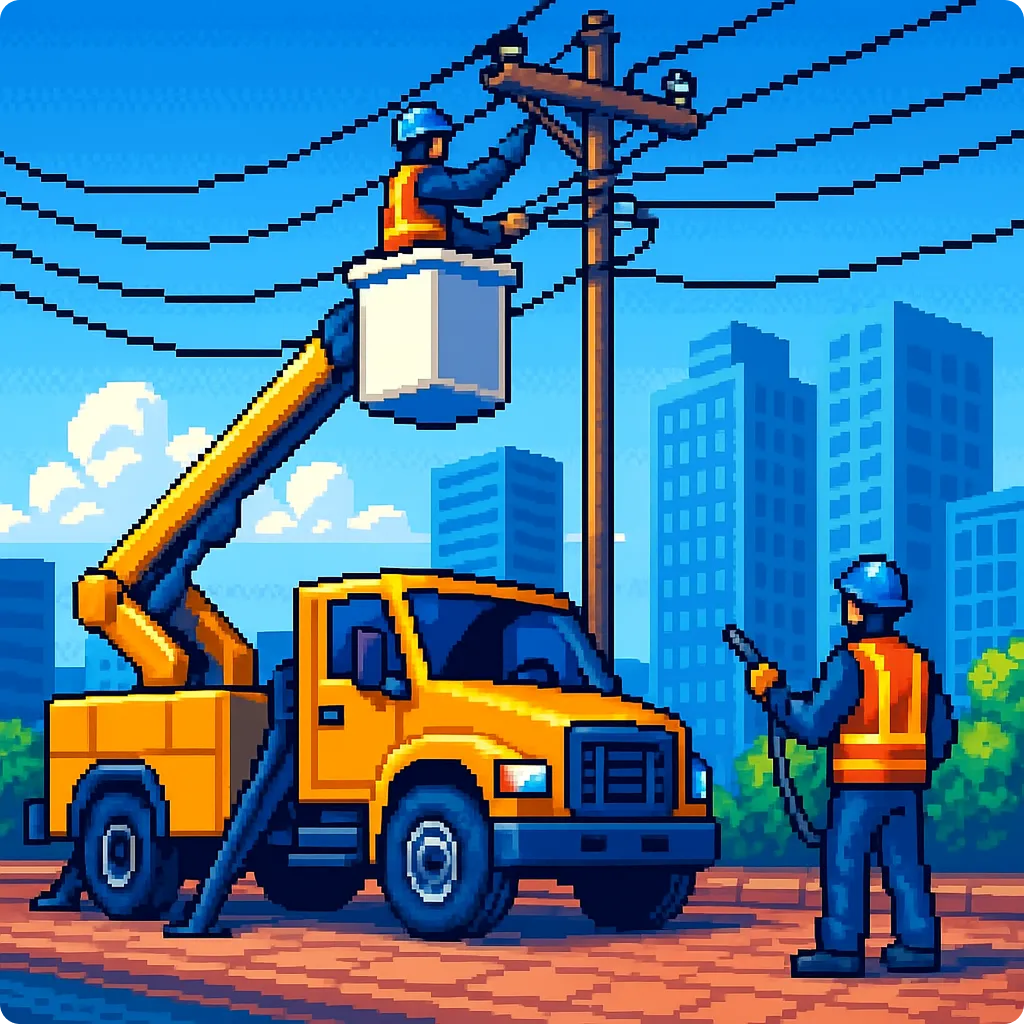

Sean Fleming: Yeah, so I might be in the minority camp. I think it's honestly easier to do green field stuff. If it's just a farm field, the poles and wires are not actually that hard to put up and you do it with all the other infrastructure development as it’s getting built. It's relatively straightforward and then you’re set for 40 or 50 years as long as you've correctly projected future demand.

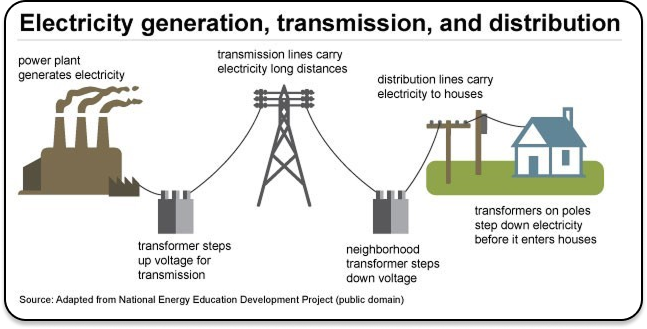

The hard thing to do is, say, in Los Angeles. The post war bungalows built in the 50s and 60s are running on old low voltage equipment that needs to be upgraded. Sometimes the needed replacement parts aren't even manufactured anymore. And because you're trying to avoid outages that affect existing residents, you're often working hot, as it were, with lines still energized (which requires a lot of expertise to do safely).

Jeff Fong: So, you need to selectively bring down parts of this graph system, and then replace it, and then turn it back on? That sounds like doing surgery.

Sean Fleming: It is a big challenge. It’s why this can be so time consuming to do upgrades, you need to orchestrate a bunch of different steps that culminate in turning a switch and hoping that people don't lose power for too long. You need to give people notice and have it all planned out. Often you have parallel equipment in place for a period of time.

It is very challenging to upgrade these things while the system is still up. You have to do as much as possible with the system still energized, and then kind of do these really complicated upgrades to avoid de-energizing it for too long.

Jeff Fong: Yeah, I hadn’t thought about that before. That sounds like that would be an organizational pain in the ass, and probably pretty nerve wracking for the person with the gloves on the power line.

Sean Fleming: Yeah, imagine you're in some rural area, there's 10 houses behind a switch, and you have to go change the transformer for some of them. Somebody's often still got to get up with rubber gloves and a long pole to physically de-energize the switch. Then, those residents are going to be without power for however long the job takes. Then you’ve got to test all the new connections and re-energize that part of the system again.

Jeff Fong: Is there a future where in-home generation, like with rooftop solar with better battery storage, makes it possible to just flip a switch, disconnect some address from the system, do maintenance, and then just reconnect without a service interruption?

Sean Fleming: The distributed batteries and stationary storage will definitely increase the capacity for individual homes and businesses to ride through outages — whether those are unintentional or intentional service outages. That will make it less problematic to take different parts of the grid down as necessary to do maintenance.

If you knew that everyone on some part of the circuit has batteries that last for a couple hours, that’s great. I think we've got a ways to go before that level of density of backup exists, unfortunately.

How Easy is it for Terrorists to Cause a Blackout?

Jeff Fong: So that’s the scenario in which you could bring down a distribution center servicing like 1000 houses?

Sean Fleming: Yeah, that's the challenge. If these substations go down it can affect a lot of people very quickly. These are even a minor target of terrorist threats, like people have shot up distribution centers with machine guns.

Jeff Fong: Right, right, there’s a weird amount of fascist literature on the idea of taking a machine gun, causing a power outage, and somehow that’s supposed to trigger a race war.

Sean Fleming: It's interesting, it's actually quite hard to bring down any meaningful chunk of a neighborhood. Often these systems have built in redundancy, so you might take out power to a few thousand people at most, but they're often quite well hidden away in urban environments. But there's more of these substations than you might expect, and any single one does not actually serve that big of a chunk of any given neighborhood.

Jeff Fong: Okay, got it. So we're probably safe from somebody causing a massive, city-wide blackout anywhere.

Sean Fleming: Yeah, so there was an incident a few years ago, somebody took out two specifically targeted substations in North Carolina that seemingly implied that they knew which ones to shoot to cause a wider spread outage. If you know the system map, some points are more important than others.

Jeff Fong: Got it. So I'm just continuing to picture the power grid as a graph and you're saying that there are some more important, highly-interconnected nodes?

Sean Fleming: Yeah, exactly.

How to Price Electricity: The California Way

Jeff Fong: Different topic — how is energy priced?

I’ve got my intro to econ intuition: things cost a certain amount, and for them to be profitable, you have to charge more than they cost. I also understand that this is a highly regulated monopoly, so there's also political negotiation about how much infrastructure investment is going to happen and, therefore, how much a utility will be allowed to charge consumers.

But I assume it’s all more complicated than just that, so how does this actually work?

Sean Fleming: That's a great question. So you're right, stuff needs to be priced at higher than it costs to produce, otherwise it's not going to get produced.

What makes this weird is that electricity is a unique commodity in two specific ways:

One, it's very costly to store. It mostly needs to be generated at the time it's consumed.

Two, power systems lend themselves to local monopolies. You don't really need two power grids in any given place. So the poles and wires lend themselves to monopolistic provision. Historically, we’ve managed this in the U.S. by turning electric utilities regulated monopolies. But that’s been changing in important ways.

The California example is actually a little simpler (though not as cleanly binary as I’m going to present here).

California has three really big investor-owned utilities — Pacific Gas & Electric (PG&E), Southern California Edison (SCE), and San Diego Gas and Electric (SDG&E). These are all what's known as vertically integrated utilities (where they actually own some or all of their generation assets). PG&E owns Diablo Canyon (the nuclear power plant) along with other generating assets. They also own and maintain the wires that actually transmit the power and then distribute it into individual homes and businesses. They interface with customers, and so they own the customer relationship.

That's distinct from restructured, retail choice markets like Texas, where there's different people that do the generation, do the poles and wires, the transmission, distribution, and actually own the customer relationship.

Jeff Fong: Do all those different parties just negotiate with each other pricing?

Sean Fleming: So let’s talk about how each model works, starting with California and then we can cover Texas — with the understanding that a lot of the U.S. exists on a continuum between these two models.

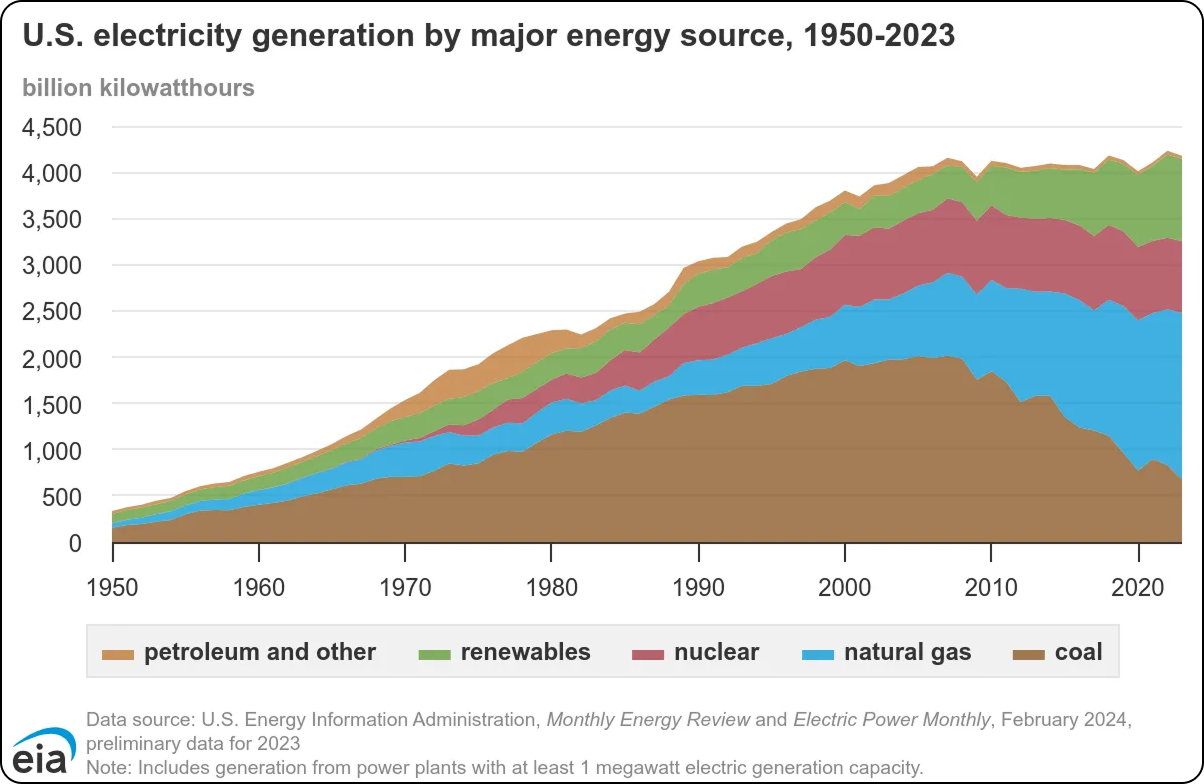

In California, if you look at like PG&E, 20% to 30% of their power is from owned generation. So they own the assets, they produce power with them, and they sell that power to their customers.

Another 40% to 60% of it comes from long-term bilateral power purchase agreements. An independent power producer (IPP), somebody that owns a gas fired power plant or a solar facility who enters into a long term contract with the utility company to provide power at a given price and under certain conditions.

For the last kind of 5% 10%, there's like a spot market where utilities procure wholesale power in regulated markets. It's usually a day ahead and for a given hour. For example, it could be as specific as tomorrow from 2pm to 3pm.

Generally that’s the way it works. There's different sources of generation that cost X dollars to provide a megawatt of power. The tricky part is, as a retail customer of PG&E, SCE, or SDG&E, you have a fixed retail rate that’s set years in advance.

Jeff Fong: This is the price that's negotiated between PG&E and CPUC in the California context?

Sean Fleming: Exactly. This is where they [the public utilities and their state regulators] are negotiating. The utilities companies make the case for how much money they want to spend on not just generation, but also transmission and distribution assets. (In fact, in the U.S. today, more money is spent on power delivery than power generation, which often surprises people.)

Then there's some regulated rate of return negotiated as well.

So they take all this money and all these complicated calculations and say, “We want to charge X cents per kilowatt-hour under this rate to these types of customers. We think X percentage of our customer base are going to subscribe to this rate, and they're going to use some expected amount of power.” They have to forecast how much power is going to be used, and who's going to pay for it at what price, etc, to cover all of their costs.

Jeff Fong: It's interesting, this almost sounds like..not Soviet-style economic planning, but maybe something intermediary, like a market socialist setup…there's prices, kind of, but only after negotiation after which prices get set for some extended period of time.

Sean Fleming: Yeah, that's right. And I'd say the rates are simpler and more stable for residential customers. They can often be more fluid for industrial scale customers. These customers often end up more exposed to actual wholesale power prices.

For retail, or residential customers, the goal is to keep it as simple as possible. And that comes at a cost. You don't really get the price and value discovery that you get in a fully competitive market. You can sort of gesture at time of use rates, but even those are not nearly as steep and as flexible as is implied by the cost of generation.

How to Price Electricity: The Texas System

Jeff Fong: To the point that I think you're making throughout all of this, it sounds like the transaction costs for delivering power are just high, and that price discovery might fall down under a more flexible system.

Sean Fleming: Well, so it's interesting. Compared to the vertically integrated systems we historically have in the U.S., we also have what’s known as retail choice markets. Texas is probably the most notable example.

So, in this setup, they’ve separated out generation, delivery (transmission and distribution), and the customer relationship. There's a lot of flexibility for each layer and particularly for the people at the end — the retail energy providers (REPs)— to define their business model and figure out how they want to set prices for end customers.

If you think about, the retail energy providers are structurally short the power market, and utilities are as well in the sense that they have a commitment to provide their customers with power, and they have to figure out how to cover that short by delivering power at a specific time and place (the customer’s residence).

If you're a big REP, you might have long term bilateral power purchase agreements with an independent power producer like NextEra or Calpine for the next 10 or 20 years to cover most of your expected demand in a really stable way. But there’s no law of nature that says you have to, you can take risks.

The most extreme example is a company called Griddy (that no longer exists). Their promise in Texas was that they were going to charge you $9.99 a month plus the wholesale price for whatever power you used. That was a great deal until it wasn't. And when it wasn't, it was when winter storm Uri made power prices shoot through the roof.

For context, at the time in Texas, power might cost $50 a megawatt hour ($0.05 per kilowatt-hour) and maybe that spikes to $200 in the evening on hot day. During Uri, this got to $9,000 per megawatt hour (the scarcity pricing price cap) from people trying to heat their homes.

People ended up with these giant bills, there was a big lawsuit by the State Attorney General, Griddy went bankrupt pretty much instantly, and it was a huge mess. This is one of the risks of an energy-only market like Texas: price volatility is needed to bring in new generating capacity, but while those high prices exist it can be painful for those affected.

There have been regulatory tweaks to try to avoid this type of edge case again, but the flexibility the system affords allows operators in deregulated markets to be more creative in their business models, which many believe is more efficient long-term.

So you see really interesting innovation happening with companies like Sunrun, Base Power, David Energy, Octopus Energy. They might install a battery in your home (or solar panels + battery in the case of Sunrun) and manage the battery on the customer’s behalf and use it to offset power usage during peak times, delivering a very low price of power to the customer as a result.

They use that distributed asset to manage the peak demands to make the bill as low as possible, basically, in a way that isn’t really viable where the utility owns both the poles and wires and the customer relationship.

Jeff Fong: In this model, are the retail energy providers operating in geographically exclusive markets? Or, in the same neighborhood, could you have three different retail providers to choose from?

Sean Fleming: Generally, there is no regional exclusivity with REPs, and you’d expect to have multiple to choose from. I'm sure some of them focus on Austin versus Houston or Dallas, but (to wildly oversimplify) they’re just like a power trading desk and a good website, with somebody else actually running the wires.

Jeff Fong: This whole business sounds like a hedge fund. Like you're trying to predict the future and getting on the right side of a bunch of trades. So, in this model, someone else owns the wires for transmission and they just lease out access?

Sean Fleming: Yeah, in Texas, it's a utility like Oncor. They own and maintain the wires, and they'll charge some fee to the end customer. In the Griddy example, that was part of the $9.99. It was a grid access charge.

It’s funny, though, you talk to some of these businesses and they’re like (a) a customer acquisition team, (b) a battery installation and ops team, and (c) the power traders and modelers trying to develop the right algorithms to know when to power your home off the battery and not the grid.

Sean’s Verdict? Point Texas.

Jeff Fong: Okay, so we’ve gone over both ends of the regulatory spectrum with California on one end and Texas on the other — do you have a sense of which approach works better?

Sean Fleming: I think markets like Texas, and ERCOT in particular, are more flexible and this has allowed people to innovate and bring new technologies to market faster. It’s also allowed for greater diversity in business models which has then enabled better price discovery and faster deployment of new assets. As a result, Texas has some of the lowest energy prices in the country, if not the world.

Earlier this year, I spent time working on sustainable aviation fuel. If you talk about one of the best places to build a new electrolysis plant for hydrogen, it's in west Texas because the power is just so cheap. There's also the flexibility to interconnect big loads on short notice.

Jeff Fong: Well, I have to ask, what about the big power outage that we talked about where everybody froze and Ted Cruz ran away to Mexico? If the system is so good, what's going on there? And maybe the answer is just that a big exogenous shock is a big exogenous shock, the same way something happened to California like twenty years before?

Sean Fleming: Good question.

Because the delivery of electricity is effectively real-time with its generation (because storage is expensive), there needs to be buffers in the system. Historically, that buffer has been spare generation capacity and spare capacity on the wires to deliver energy where it needs to go, so that if a generation facility goes down or a line goes down, you can still deliver power to people.

Jeff Fong: I want to make sure I hear that correctly. You’re saying we always need spare capacity. And the way that has historically been built into the system is that we were producing 10, but maybe we could scale up to 50. Similarly, if we were transmitting 5, we could always start pushing 15 at any given point in time. We could always just make more and push more through the system if part of it goes down or if demand springs up.

Sean Fleming: That's right. If you think about things at the generator, if it's not the hottest afternoon hour of the year, there's usually spare generation capacity somewhere on the grid. Or in the Texas case, if it's not the coldest hour of the year, there's generally spare capacity somewhere on the grid.

Similarly, the transmission system is generally operated with what's known as an n-1 contingency. So you can lose the node and the system will still operate.

Anyway, there's going to be backup somewhere in the system. And it's almost a societal decision on where that backup is and who is best placed to bear that risk.

Historically, it was up to the utilities. Vertically integrated utilities (like in California) internalized those risks and were managed for their capital to spend across all those buffers and for their reliability, their outage rates. But having one party manage all of these different capacities and these risks is not necessarily the most efficient in an iterated game.

Texas took a very different approach from a regulatory perspective. It said, we're going to let each of these providers compete against each other to deliver what we need. They decided to regulate the actual poles and wires part of the natural monopoly, and for the other pieces, we’ll make what's known as an energy-only market.

Sometimes that energy is really expensive because it's super cold and the power goes out, and everyone wants to use their heated blankets to stay warm. In Texas, the system strained and broke under that unprecedented demand and loss of supply (there were a number of unplanned outages at both gas and renewable generation facilities). But most of the time, their energy is cheaper than almost anywhere else in the country.

It does help that natural gas is very cheap in Texas, which is also remarkably windy and sunny; one can overstate how important regulatory structures are.

Ultimately it is a societal decision about where the buffers are. There's a question of, should we as individuals be living our lives such that if the power goes out for three days, we might die. Some people do live under those conditions. People with plug-in medical devices are probably the most notable across the country. Again, this is why scheduling outages is so hard. If somebody's got a ventilator that they live on at home that's plugged into the power, that's hard to schedule around.

But the whole point is, there's gonna be buffers in the system somewhere. And we have to decide if it's worth it. Or whether it’s cheaper for everyone to have… extra cold weather clothes and thermal chemical warmers or a generator? Or is it better to have all the spare capacity at the generation level and in the wires level, or to decentralize more of it to the individual businesses and homeowners? I'm not sure.

Jeff Fong: To go back to your preference for the more decentralized Texas system, you’re saying the Texas system is probably more efficient because it's more flexible, so there's more price discovery. But also, that flexibility results in new technologies or ways of doing things to get tried out and adopted more quickly.

On the flip side, is it also fair to say that such a system also has less buffer capacity built into it, at least relative to the other end of the spectrum in California?

Sean Fleming: If you roll the clock back 15 years, call it 2010, I don't think people would say that the Texas system is way better. It didn’t have way lower electricity prices than comparable markets in other parts of the southern US.

But the market for power and the way that we generate electricity has changed a lot in the last 15 years, and because of the flexibility inherent in the Texas system, the state has adapted much more quickly than we've seen in other markets.

So from the generation side, the fracking boom unlocked huge amounts of natural gas for low cost in Texas. But then people were able to build new gas fired generation. Similarly, as the price of solar and wind came down Texas has become the leading developer of new solar and wind assets, even more than California. The Texas market just had the flexibility to adapt.

This still happened in California, but it just happened more slowly, and perhaps less efficiently.

On the consumer side, as we start to talk about constraints again, at the household level a consumer might want to plug in an EV or two EVs or two giant Hummer EVs, and want to charge them all at home. And the utility might say, “Oh, the wires can't support you and your neighbor and everyone on the cul-de-sac doing that. It's going to cost a bunch of money and time to upgrade the system to accommodate that new load.” Versus in Texas, companies have more flexibility to craft business models that can kind of buffer those peaks.

Jeff Fong: This is the example you gave of Texas companies installing a home battery and toggling a homeowners power consumption on/off the grid as needed?

Sean Fleming: Yeah, a number of folks are doing this. They’ve found it’s cost effective for them to come in and install the battery in return for getting to control it as part of the system.

The Future of Energy Production

Jeff Fong: Last question. What's the next big thing? What’s coming down the pipe that we should all pay attention to as urbanists, policy wonks, terminally online nerds, etc?

Sean Fleming: I think this is very much a situation where the future is here, it’s just not evenly distributed. What you're going to see more and more of is the deployment of distributed energy resources, whether that's EVs or stationary batteries, and solar panels. We're going to see more and more batteries, but also generation at the edge of the grid. Most new EV charging stations are going to have a battery on-site to buffer peak usage and reduce the impact of the upgrades required for the grid. We may see the same with new subdivisions or upzoning, as a way to alleviate potential grid constraints.

These trends are going to continue and be increasingly important to the way utilities interact with their customers. In places, this technology may allow more people to even go off-grid, though I expect that to remain somewhat limited. That's all the micro scale electrification stuff that you're going to see within cities.

At the other end of the spectrum we have data centers and other really large loads. We're going to increasingly see behind the meter, or off grid generation.These are systems where you have generation alongside the data center — whether that's solar, wind, gas, or fire generation, plus batteries — all in the name of reducing time to power (the time it takes to get the power needed to run the datacenter).

You're likely going to see the central role of the vertically integrated utility be reduced as other people and other players in the market bite off use cases through distributed batteries, distributed solar on site, gas generation, etc.

Jeff Fong: Am I hearing you say that the need for more distributed power generation at the site level…that it makes the Texas model make more sense?

Sean Fleming: Yeah, the flexibility just allows you to more easily do these things and try out new business models.

There's fundamental limits to all of it, though. You're not going to power a 40-story office tower downtown with solar panels and a battery. That requires the grid and it's going to continue to require the grid.

It's for the really big stuff (like the data centers) and for the really small stuff (like individual homes) where there's more room to play. Maybe a long time from now we'll meet the middle and that office building will have its own power generation on site, but I think we're going to see the biggest immediate impact on the ends of the barbell — and that's more possible in markets with regulatory flexibility.

The EndComing out of this conversation, I have a much better appreciation for everything it’s going to take power the cities of the future. I’d already heard plenty about the need for more energy generation (nuclear, solar, etc), but the problem being concentrated in the transmission infrastructure was new to me.

More than that, though, I’m fascinated by the different regulatory approaches and the points Sean made about price discovery leading to faster technology adoption. I’ll admit I assumed Texas had just been playing wild west with their energy infrastructure, but I’m coming around on the more decentralized market structure the state currently has in place.1

Bigger picture, I feel like my urbanism will no longer take for granted a critical layer of infrastructure. So, that’s all to say I definitely learned something and I hope all of you did, too.

I was raised there, I get to make fun of the place