MAGA declares war on the property tax

Republican politicians decide they like California after all

In a recent Twitter post, Representative Marjorie Taylor Greene called for an end to property taxes. Meanwhile in Florida, Governor Ron DeSantis has been advocating for the elimination of property taxes in his state. Vivek Ramaswamy (remember him?) called for the same during a campaign speech in Ohio.

So, MAGA is all-in on nixing the property tax and, in an American context, this makes a lot of political sense. From a policy perspective, it’s one of the worst ideas imaginable. And, ironically, Republicans need look no further than California to see exactly why.

Why Americans Hate Property Taxes

The United States is a nation of homeowners. This is the result of a concerted effort on the part of the federal government to subsidize homeownership following World War II. Easy credit and car-centric infrastructure changed where (as well as how) Americans live and gave rise to the modern-day U.S. suburb.1

Once Americans became homeowners, we became increasingly sensitive to property taxes, for several reasons.

Historically, homeownership was pitched as The Path to middle-class prosperity.2 The idea was that, after paying off the subsidized loan used to buy a house, homeowners could expect their property to continually appreciate in value, and use those gains to fund their retirement. Property taxes are thus a tax on what Americans have been told for generations is supposed to be their main vehicle for savings.

The problem with this is that suburban homeowners are overwhelmingly owner-occupiers. The houses they live in—though they might increase in value in a hypothetical, speculative sense—don’t generate a stream of revenue that can be used to pay off taxes. If the value of a property goes through the roof (no pun intended), an owner’s ability to pay their taxes doesn’t necessarily increase with it.

And on top of all that, the property tax is what we’d call high salience. It’s a large, once a year bill that feels jarring and impactful in a way that the slow bleed of monthly income taxes withheld from an employer's paycheck do not.

So, Americans hate property taxes. And when enough Americans hate the same thing all at the same time, we tend to revolt.

We’ve Seen this Show Before

In 1978, an angry old man named Howard Jarvis succeeded in changing California’s property tax system in a truly profound way. He successfully floated a statewide ballot initiative to limit property taxes: the infamous Proposition 13.3

The proposition’s purpose was to limit California’s ability to collect property taxes which it accomplished by capping them at 1% of assessed value at the time of purchase.4 For tax purposes, reassessment would only occur if the property changed ownership.5 This means that if you bought a house in San Francisco in 1978, you’re basically paying 1% on the inflation-adjusted value of what the property was worth when Jimmy Carter was President.

Prop 13’s immediate impact was to reduce the state’s budget, precipitating spending cuts that have hampered public education ever since. More broadly, this has forced the state to rely on income and capital gains taxes to fund public expenditure. Not only is this bad for overall economic growth, it also makes the state budget super sensitive to the boom and bust cycle of the stock market. When the stock market tanks, California goes broke.

At the local level, this has also encouraged the growth of fee culture wherein municipalities desperately nickel-and-dime things like new housing — not because it’s good policy, but because it’s a legally and politically feasible way to raise revenue.

More subtly, Prop 13 has also acted as a multiplier on California’s baseline level of NIMBYism. No matter how expensive housing becomes, anti-housing homeowners remain completely insulated from runaway prices, even as they block new construction.

To give the devil a fair shake, reasonable people can have reasonable complaints about property taxes. If the local economy booms, and property values boom with it, retirees on fixed incomes may have a hard time keeping up with their taxes. That’s a problem with a solution, though. As the name suggests, a property tax deferral program allows seniors to defer paying their property taxes until death. At that point, accumulated taxes are paid by the estate (which can presumably cover the bill by selling the property).

On a more emotional level, property taxes often evoke a sense of unfairness. As Governor DeSantis put it, “Property taxes effectively require homeowners to pay rent to the government”. The unfortunate reality is that there’s an entire constellation of municipal services and infrastructure required for even suburban development. These things cost money and the best way to raise that money is to charge the people who benefit from the value said infrastructure provides.

If MAGA lawmakers insist on following in California’s footsteps, they’ll end up in at least as bad a place...though I’d wager they’ll manage to land somewhere even worse.

A Different Path

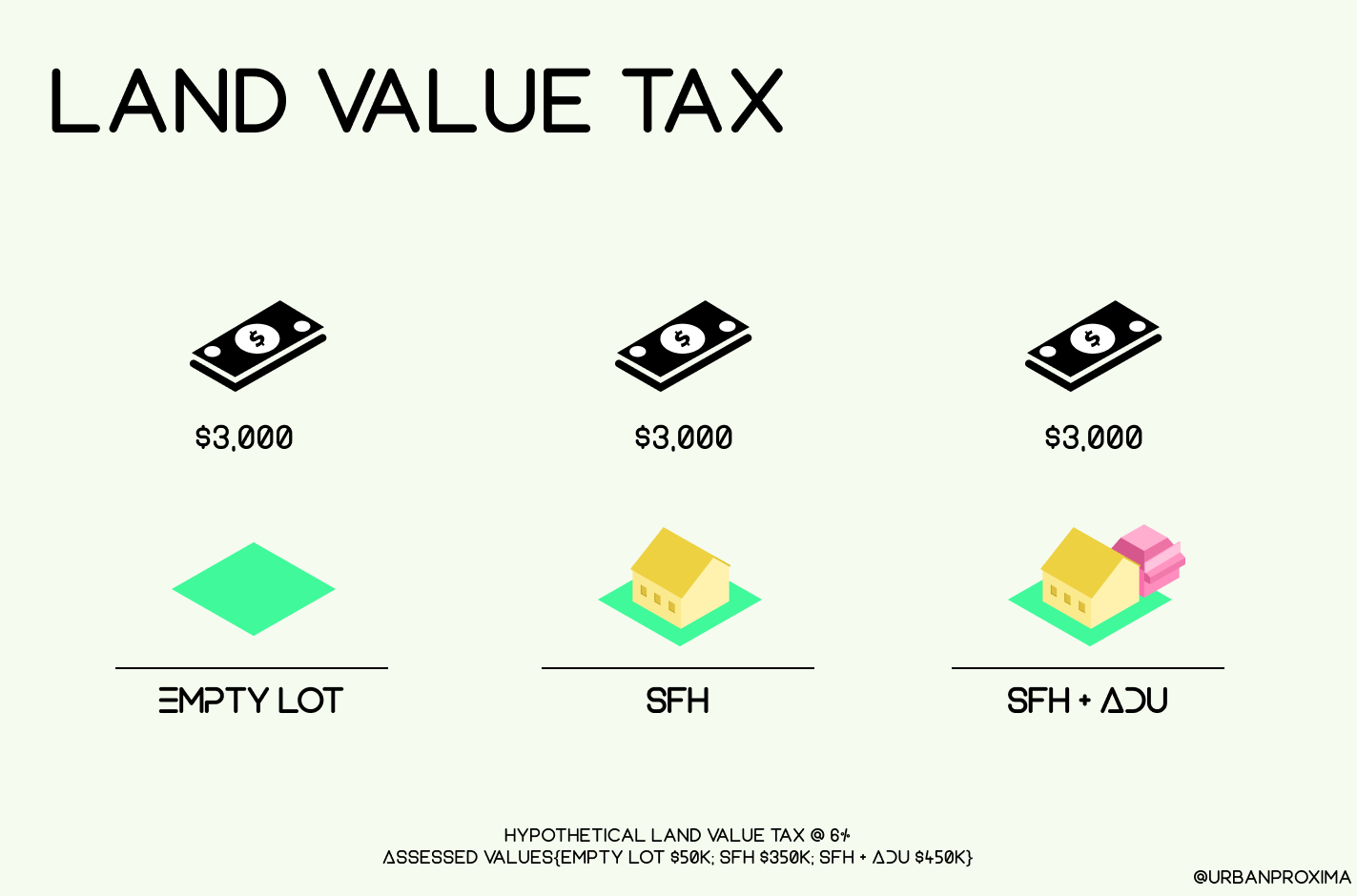

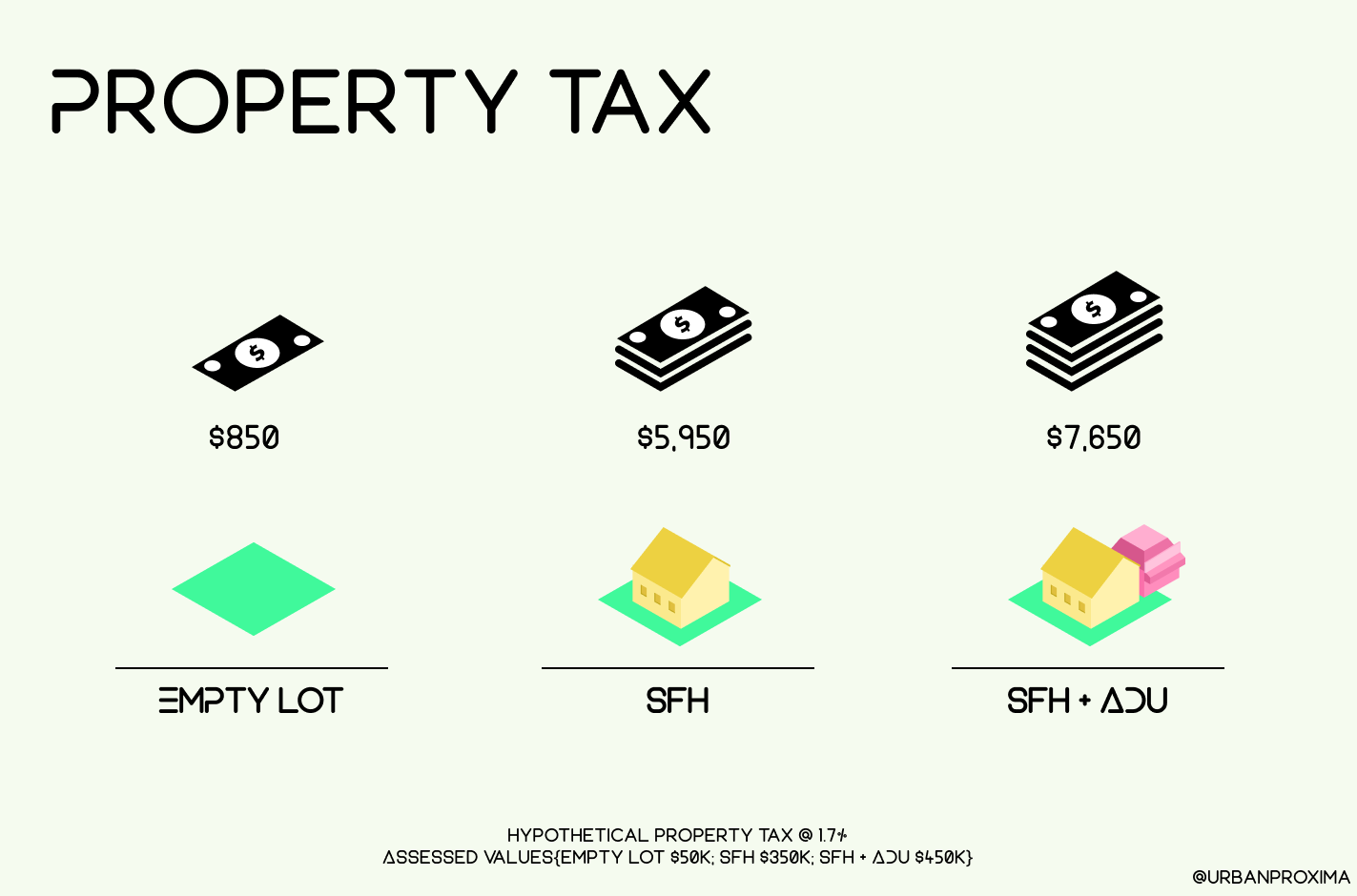

Despite the fact that getting rid of property taxes is Not a Good Idea, that doesn’t mean that existing property tax regimes are necessarily optimal. Property taxes, after all, punish development because they factor in the value of the house or whatever other structure happens to be built on top.6 Instead of abolishing property taxes, shifting to land value taxation (LVT) would constitute an actual improvement.

In brief, an LVT works like a property tax, but only applies to the value of a parcel’s land (i.e. it doesn’t tax the value of any buildings or infrastructure on top). So, if you own a $350,000 property where the land component is worth $50,000 (and the building is valued at $300,000) an LVT would only tax you based on the $50,000 value of your land.

All else equal, a vacant lot and a parcel with a building get the same treatment. In an area where land has become valuable, it incentivizes denser development and disincentivizes keeping expensive land out of use.

Importantly, an LVT can be structured such that it’s somewhere between a tax break and net neutral for homeowners.

As an example, Lars Doucet recently did the math on his own single-family home in Texas. Going from a 1.7% property tax to a much higher (in percentage terms) LVT constituted a break in his bill. Lars calculated that:

Even with a massive 6% LVT rate, I still save about two thousand bucks, as would other median Texas homeowners like me.

Anything that constitutes a tax break will be popular with homeowners, but it’s important to remember that this would probably increase tax receipts overall. In this hypothetical, vacant lots and underutilized surface parking start to pay much higher taxes and probably get put to better use over time — that means more housing and commercial space, and, consequently, more economic activity. On top of that, existing homeowners would no longer be financially punished for building an ADU or otherwise improving their property.

Obviously, all that assumes local land use rules allow that kind of redevelopment, but that’s a different work stream and the underlying logic still stands.

The Politics of Decline

Whether the proponents of property tax abolition would ever embrace such a policy…well, I’m not holding my breath.

On one level, we’re not exactly dealing with the greatest policy minds to ever hold sway in the American Republic. On a deeper level, the individuals in question are simply not selling a vision of widespread prosperity. Gone is even the pretense of a rising tide that lifts all ships and in its place is a politics of grievance and privilege. Downstream of that, all policy looks like rent seeking.

We’ve already seen where that road leads in California: broken budgets and a dysfunctional political-economy. If MAGA remains intent on walking the same path, it’ll succeed only in hamstringing state and local budgets, all while mortgaging the country’s future for nothing more than a few extra points in polling.

Note that subsidies weren’t shared out equally. American minorities not only didn’t have access to the cheap loans that vaulted other folks into the landowning class, they faced prejudicial terms in what credit they were able to access along with a host of legal barriers to acquiring housing even in situations where money was not an issue.

Arguably, the American penchant for land ownership goes back to the Jeffersonian conceptions of the yeoman citizen. Later in the country’s history, government organs like the Department of Labor launched pro-home ownership campaigns as part of the government’s anti-communism efforts. This continued after WWII with the creation of quasi-government agencies Fannie Mae and Freddie Mac, the institutions that buy mortgages from originating banks, thereby ensuring a constant supply of credit.

In California, after gathering enough signatures, anyone can propose a new law which the entire state then votes on in a general plebiscite.

There are some additional details in the original ballot text plus several years of follow-on legislation to deal with some of the knock-on effects of prop 13, so, like most things, it’s slightly more complicated.

The definition of “ownership” does a lot of work here. Savvy property owners put properties under the ownership of transferable trusts. When an owner wants to sell a property, they just transfer control of the trust. This way, the ownership of the property never changes — it’s still under the ownership of the trust — so reassessment never occurs.

And if you take the Strong Towns growth Ponzi Scheme thesis seriously, cities and states may be grossly undercharging property owners for the value of the infrastructure they provide anyway...but that’s a whole separate can of worms.

The US is middling as a nation in terms of homeownership rates. As much favoritism as homeowners receive here and the rhapsodies we sing in their support, the US has not succeeded in promoting it. The success for home ownership has been a great wealth transfer from renters and new homeowners to incumbent homeowners.

Yes, I would love to see property taxes replaced by a land value tax. Even better, eliminate the vast majority of state and local taxes and replace it with an LVT.